Still relying on spreadsheets? Here’s why you shouldn’t.

Launched in 1985, Microsoft Excel has graced the screens of millions of PCs around the world. Whilst it’s not the world’s first spreadsheet application, it quickly became the de-facto place to store and manipulate data.

In 2010, a staggering 81% of all businesses used Excel – but despite this figure dwindling down to 54% by 2019, spreadsheets are continuing to make their way into payroll departments.

There’s no questioning the value of spreadsheets as an indispensable tool for some data-based business tasks. But for too long now, payroll departments have come to rely on them for their business as usual tasks – often at their peril and at great expense to their operations.

So, why do some payroll departments continue to rely on spreadsheets?

Once upon a time, spreadsheets were the best place to make all sorts of payroll-based calculations. This included calculations for pay, taxes and even holiday entitlements. But over time, payroll software has since become the dominant way to automate most of these tasks.

So why, in 2022, are payroll teams still turning to the spreadsheet? There is some incredible payroll software on the market. Some use older payroll systems that are still on-premises (run on-site on the company’s own computers or servers). Many have made the jump to the cloud, giving them on-demand secured access 24/7 from anywhere. But not all payroll systems are created equally.

In Australia and New Zealand, the payroll, tax and holiday legislation has made it difficult for payroll software to stay up to date. In New Zealand, there are complexities associated with the Holidays Act which came into force in 2003. This seemingly simple ‘act’ has become a payroll nightmare for some, with plenty of well-publicised payroll disasters emerging ever since it came into effect.

Then in Australia, there’s the modern awards system which came into effect in 2010 and has induced heartache for many a payroll specialist. Because of the changing legal climate in both of these places, businesses that use a ‘generic’ off the shelf payroll software can miss the nuances of these local laws. And for those who do use region specific software – if it’s not updated regularly, then there’s a good chance it’s not reflecting the latest laws in its calculations.

So, to get around this – many payroll departments in Australia and New Zealand will use spreadsheet applications like Excel to make the manual calculations that their payroll software can’t.

If you’re still using spreadsheets, don’t bury your head in the sand – understand the risks!

Spreadsheets were never designed or intended to be used as a complete payroll solution. Many have adopted them as they are cheap and quick to use – and most people are able to use formulas to get basic calculations done. However, their biggest flaw is that they largely rely on manual data entry, are very prone to human error and present a significant data security risk. Most significantly – when people start sharing access to spreadsheets, version control runs away with itself and all it takes is for one person to change a formula (without realising). This minor error is the trigger for massive data inaccuracy and a potential nightmare further down the line.

The truth is, spreadsheets have been responsible for some mighty errors. PwC’s own research shows that 90% of all spreadsheets with 150 rows or more contain errors. Meanwhile, KPMG found errors in 91% of a sample of just 22 spreadsheets. Here’s some real-life blunders that put this into perspective for you:

In 2003, a simple misalignment of spreadsheet rows cost Canadian power company TransAlta an eye-watering $24 million. It meant the wrong bids were matched with the wrong contacts and the mistake wiped out 10% of the company’s profit for that year. It was all down to a simple copy and paste error.

In 2005, photography and imaging giant Eastman Kodak ended up overstating their figures by $11 million. All it took was one little Excel typo where an employee added too many zeros to a severance accrual record.

In 2008, global investment firm Barclays Capital was forced to spend millions on worthless contracts after a reformatting error in Excel. 179 buy orders were accidentally hidden in the spreadsheet instead of being deleted – and the company was legally obliged to foot the bill for the additional contracts. Ouch!

In 2010, the UK’s MI5 illegally bugged 134 phone numbers. The botched operation meant they had bugged the wrong phone lines – and the spreadsheet formatting error changed the last digits of each number to 000. Meanwhile the real suspects were not being monitored at all. Madness!

In the pharmaceutical industry, confidentiality is everything. Except when an Excel templating error means that confidential information is accidentally leaked to external financial analysts. This happened to AstraZeneca in 2011.

Then the almighty of spreadsheet tragedies. A $6 billion trading loss for global investment bank JPMorgan after a simple copy and paste error in Excel. Just a simple keyboard stroke by a well-meaning employee led to the company greatly underestimating a risk factor – leading to a ridiculously painful trading loss.

Still not convinced? Here’s 5 reasons why you shouldn’t rely on spreadsheets any longer!

1. Spreadsheets are routinely inaccurate

As we’ve just seen, it takes the most minor of human mistakes to lead to a string of errors. Spreadsheets are a very crude tool for data entry and manipulation. Since spreadsheets are often home-grown and put together informally (without sophisticated testing and validation), you have to assume that errors are lurking in every spreadsheet you come across.

2. Version control and data integrity an accident waiting to happen

You may have painstakingly setup a spreadsheet and meticulously built the formulas, structure and referencing. That’s just the beginning. You need to find a way to share it in a secure way, applying controls to ensure that the formulas can’t easily be changed. The advanced skills needed to do this don’t normally live in any department (payroll included). Without ongoing checks and maintenance, your perfectly prepared spreadsheet won’t stay that way for very long.

3. Sharing spreadsheets is like the child’s game, ‘telephone’

You can probably keep a spreadsheet that ‘only you access’ under control. But by the time you start sharing it across the departments of a business, all hell can break loose. People end up working from multiple versions of the document. Some people add data to the online version – but others download and then re-upload. Multiple versions end up being spread all over the place. Before you know it, severe errors and formula troubles are all over the place. And unless you have the forensic skills of a world-class detective, you don’t know which version of the document is actually correct.

4. Hours wasted sifting, sorting and consolidating data

As you add more and more data, the more unwieldy your spreadsheets can become. Before you know it, you’re spending more and more time trying to sift, sort and consolidate data. Without realising it – you’re creating a lot of additional admin time that should really be adding value somewhere else.

5. Spreadsheets don’t plug into other systems so easily

One of the beautiful things about modern pay payroll systems is the simple integration with HR and performance management tools. When used together, these can provide highly scalable solutions that save time, unlock efficiencies and drive greater performance from your people. However, spreadsheets were never designed to link directly to your other HR tools and systems – so you’re missing a trick in terms of the efficiencies to be had.

What’s the alternative?

Are you stuck in your ways, using outdated spreadsheets, legacy systems or having to flick back and forth between clunky payroll and HR tools?

The panic of data accuracy will always be in the back of your mind — not to mention feeling grumbly about the inflexibility of it all too!

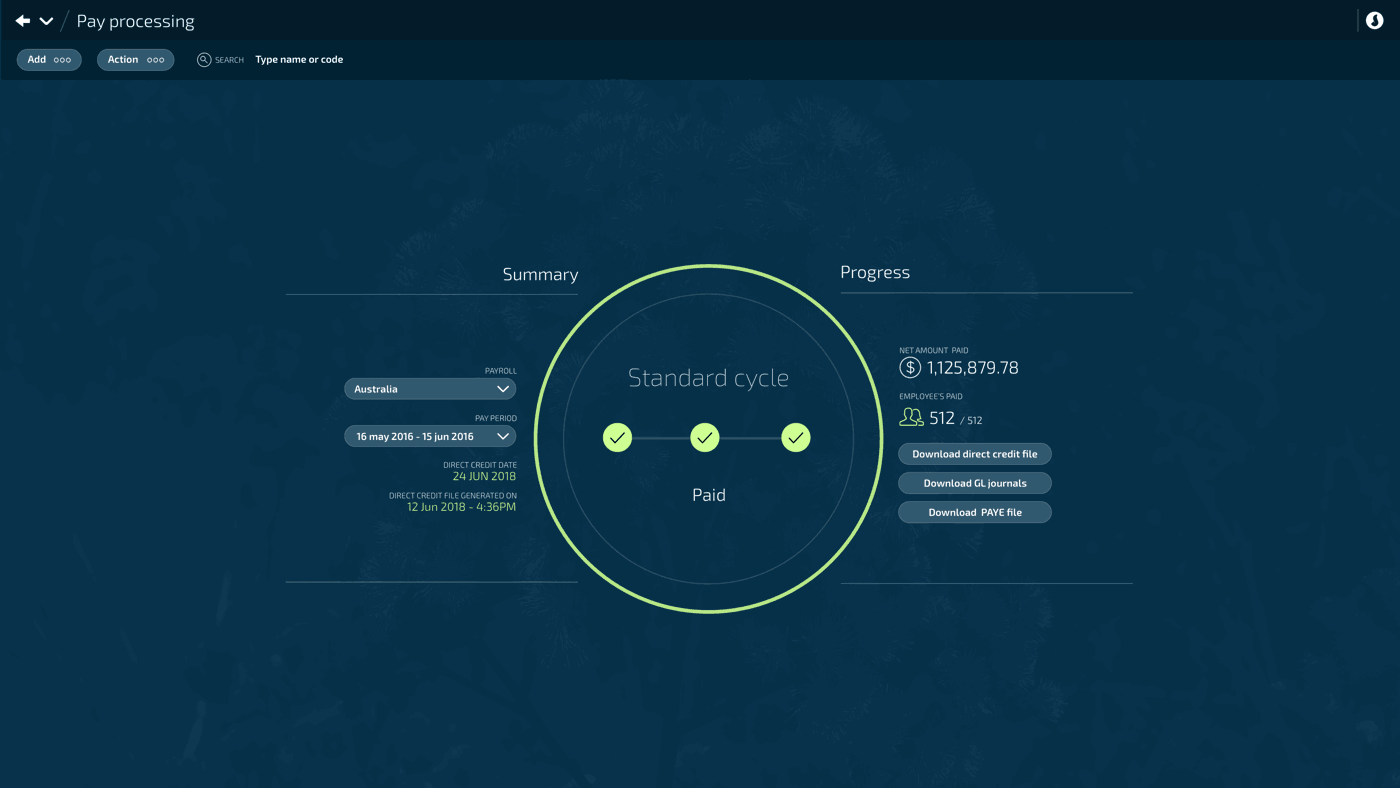

Cloud-based payroll systems like Jemini do all the heavy lifting for you. They were designed to meet the special nuances of payroll in Australia and New Zealand. By design they take into account the complexities of things like the Holidays Act (NZ) and the pay awards system in Australia. They are date-effective – meaning that if someone joins you mid-way through a pay period, their pro-rata pay is calculated automatically. That way you don’t need to turn to a spreadsheet. These modern platforms accommodate the way people actually work today – think part-timers, multiple different pay periods and even those who do gig-type work. When you have a myriad of people on different terms and contracts, you need the flexibility and the capability to pay every single person correctly – leaving nothing to chance.

In conclusion, spreadsheets are tempting. We don’t often see the risks in turning to a tool like Excel for routine calculations. But as we’ve seen, under the hood of spreadsheet applications are a wide range of pathways for dangerous errors to rear their ugly head. Sometimes you know something doesn’t look right which can force you to spend hours trying to re-trace your steps. Other times, errors are completely hidden and only months or years later, a payroll scandal can rock the very foundation of your business. With the latest generation of cloud-based payroll software, you benefit from a truly spreadsheet free working environment and a superior experience for everyone – from your payroll team to each individual employee.

Once upon a time, spreadsheets were the best place to make all sorts of payroll-based calculations. This included calculations for pay, taxes and even holiday entitlements. But over time, payroll software has since become the dominant way to automate most of these tasks.

So why, in 2022, are payroll teams still turning to the spreadsheet? There is some incredible payroll software on the market. Some use older payroll systems that are still on-premises (run on-site on the company’s own computers or servers). Many have made the jump to the cloud, giving them on-demand secured access 24/7 from anywhere. But not all payroll systems are created equally.

In Australia and New Zealand, the payroll, tax and holiday legislation has made it difficult for payroll software to stay up to date. In New Zealand, there are complexities associated with the Holidays Act which came into force in 2003. This seemingly simple ‘act’ has become a payroll nightmare for some, with plenty of well-publicised payroll disasters emerging ever since it came into effect.

Then in Australia, there’s the modern awards system which came into effect in 2010 and has induced heartache for many a payroll specialist. Because of the changing legal climate in both of these places, businesses that use a ‘generic’ off the shelf payroll software can miss the nuances of these local laws. And for those who do use region specific software – if it’s not updated regularly, then there’s a good chance it’s not reflecting the latest laws in its calculations.

So, to get around this – many payroll departments in Australia and New Zealand will use spreadsheet applications like Excel to make the manual calculations that their payroll software can’t.

Keen to read more?

Share this page

Ready to transform your HR & Payroll process?